EUR/USD – Consolidation Persists Below 1.1700

Key Highlights

- EUR/USD struggles to reclaim 1.1700

- USD trades sideways in mid-98s

- Markets await heavy US data slate

- ECB commentary remains secondary

Market Overview

EUR/USD remains range-bound after posting modest gains but failing to break above the 1.1700 threshold. Mixed US data, including ADP employment and ISM Services PMI, have left the dollar without clear direction, reinforcing consolidation across major FX pairs.

Attention now turns to Thursday’s dense data calendar, with US jobless claims, trade balance, unit labor costs, and Challenger job cuts all feeding into expectations ahead of Friday’s non-farm payrolls. On the European side, factory orders, producer prices, and ECB inflation expectations add context but are unlikely to override US-driven momentum.

Technical Outlook (H4)

- Stochastic holding in mid-range

- Price remains below 20-period EMA

- Bias slightly bearish while capped

Key Levels

Resistance: 1.1733; 1.1783

Support: 1.1622; 1.1568

Fremora Takeaway

EUR/USD remains trapped in consolidation, with 1.1700 acting as a firm ceiling. A sustained move requires a data-driven catalyst, with US labor data likely decisive. Until then, range conditions dominate.

GOLD – Pullback Signals Caution at High Levels

Key Highlights

- Gold reverses after three-day rally

- Profit-taking emerges near highs

- USD stability limits upside follow-through

- US data back in focus

Market Overview

Gold retreated on Wednesday, breaking its short-term winning streak and slipping toward the $4,420 area. The move reflects growing caution at elevated levels, as traders lock in gains despite ongoing geopolitical uncertainty.

With the US dollar trading sideways and no fresh escalation in risk sentiment, gold’s correction appears technically driven rather than fundamentally triggered. Broader precious metals weakness, including silver, reinforces the corrective tone ahead of key US data releases.

Technical Outlook (H4)

- Stochastic attempting bullish turn from oversold

- Price holding just above 20-period EMA

- Stabilisation attempt underway

Key Levels

Resistance: 4496.54; 4550.92

Support: 4385.86; 4333.18

Fremora Takeaway

Gold is cooling after an extended rally, but the broader structure remains intact above key support. Confirmation depends on renewed buying interest following US data, with Friday’s payrolls likely the real test.

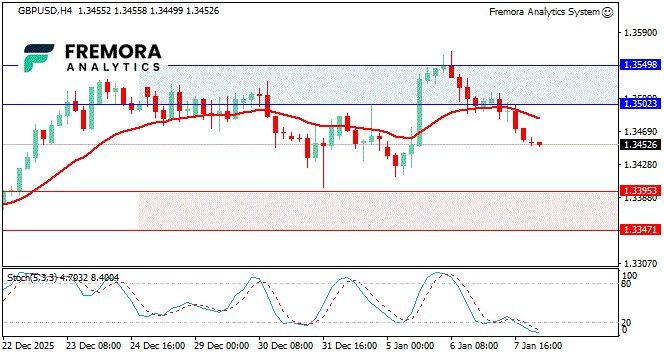

GBP/USD – Sterling Weakens After Failed Breakout

Key Highlights

- GBP/USD extends pullback from highs

- Rejection near 1.3570 shifts momentum

- USD resilience pressures sterling

- US data dominates near-term outlook

Market Overview

GBP/USD continues to slide after failing to sustain gains above the 1.3500 zone, extending its retreat from recent multi-week highs. The move reflects both profit-taking and renewed dollar stability as markets prepare for key US employment releases.

UK data remains secondary, with housing and sentiment indicators unlikely to outweigh the influence of US jobless claims and labor cost data ahead of Friday’s payrolls.

Technical Outlook (H4)

- Stochastic deep in oversold territory

- Price firmly below 20-period EMA

- Bearish momentum dominant

Key Levels

Resistance: 1.3502; 1.3550

Support: 1.3395; 1.3347

Fremora Takeaway

GBP/USD has shifted decisively bearish after rejecting multi-week highs. While oversold conditions may slow downside momentum, recovery attempts remain vulnerable unless resistance is reclaimed.

Join Our Community

Real-time charts • Tools • Analysis

Telegram → http://t.me/fremorafree

Disclaimer

Educational content only — not investment advice.