📊 EUR/USD — Holds 1.1600 as Traders Await ISM Manufacturing

Key Highlights

- EUR/USD consolidates at 1.1602 into the new month

- December Fed cut probability rises to 85%

- European data remains weak despite higher German inflation

- ISM Manufacturing PMI (US) becomes key catalyst today

Market Overview

EUR/USD ended November quietly, stuck near 1.1600 as both markets and volatility thinned out during the US holiday week. Despite the calm finish, the pair has staged a solid rebound from its November low at 1.1468, supported by a dramatic shift in expectations for a December Fed rate cut.

The FedWatch Tool now assigns 85% probability to a 25 bps cut, fueled by dovish commentary from Fed officials including Waller and Williams, both citing a fragile labor market and “room for adjustment.”

Across the Atlantic, the Eurozone offers little independent support:

- Germany Q3 GDP: 0%

- IFO Business Climate: 88.1 (down)

- Retail Sales: -0.3%

- ECB: “Policy in a good place” (Lagarde)

The only bright spot was German HICP at 2.6% YoY, slightly higher than expected, though not enough to shift ECB policy odds meaningfully.

This week’s drivers:

- Today: US ISM Manufacturing PMI

- EU HICP preliminary

- EU Producer Price Index

- Friday: US PCE Price Index (Fed’s preferred inflation gauge)

Technical Outlook (H4)

- Stochastic rising toward overbought → emerging bullish momentum

- Price slightly above 20MA → steady bullish structure

- Market building energy for potential breakout

Updated Levels (4H)

Current Price: 1.1602

| Resistance | Support |

|---|---|

| 1.1651 | 1.1551 |

| 1.1710 | 1.1491 |

Fremora Takeaway

Momentum is constructive but not explosive.

A break above 1.1651 reopens 1.1710.

Weak US ISM → bullish EUR/USD

Strong US ISM → bearish pullback toward 1.1551.

Expect the 1.1600 battle to continue until US data provides direction.

📊 GOLD (XAU/USD) — Gold Extends Rally Toward $4,220 on Fed Cut Bets

Key Highlights

- Gold trades at $4,220, up 2%+ weekly

- Dovish Fed signals dominate market psychology

- US data mixed but not strong enough to shift rate-cut expectations

- PCE inflation on Friday is the week’s biggest event

Market Overview

Gold surged early last week and held gains into month-end, finishing near $4,220 after a Thanksgiving-thinned trading environment helped suppress volatility.

The rally is fundamentally driven:

✔ Fed officials openly signaling December cut

✔ Dollar Index under pressure

✔ Yields retreating

✔ Fragile US labor market

✔ Mixed economic releases failing to support the Dollar

Fed commentary hammered this home:

- Williams: “Room for adjustment”

- Miran: Would vote FOR December cut

- Waller: Data shows labor market is weakening

- Daly: Fed should not “wait too long” to cut

With the Fed now entering blackout mode before the December 9–10 meeting, data becomes the only driver.

This week:

- ISM Manufacturing (Mon)

- ISM Services (Wed)

- Challenger Job Cuts (Thu)

- PCE Inflation (Fri) — the most important

Technical Outlook (H4)

- Stochastic rising toward overbought → strong bullish push

- Price above 20MA → structure remains bullish

- Bulls have clear control above $4,157

Updated Levels (4H)

Current Price: 4220.29

| Resistance | Support |

|---|---|

| 4274.57 | 4157.05 |

| 4341.25 | 4082.07 |

Fremora Takeaway

Gold remains a buy-on-dips market.

A breakout above $4,274 sends momentum toward $4,341.

Only a strong US PCE number would slow this rally.

📊 GBP/USD — Pound Holds 1.3240 After Budget Relief & Fed Dovishness

Key Highlights

- GBP/USD trades at 1.3241, holding last week’s gains

- Market approves UK Budget → removes fiscal fears

- Fed cut probability at 85% boosts risk appetite

- UK data remains mixed but not disastrous

Market Overview

GBP/USD made a clean breakout last week, climbing from 1.3030 → 1.3240+, supported by:

✔ A well-received UK Budget

✔ Broad USD weakness

✔ Surging Fed rate cut odds

✔ Improved sentiment across risk assets

Even though the OBR cut 2025 growth forecasts, markets praised the Budget for avoiding aggressive tax shocks and maintaining fiscal stability.

However, structurally:

- UK economic data remains soft

- Composite PMI 50.5

- Retail Sales -1.1%

- Growth expectations muted

This week’s drivers:

- ISM Manufacturing (Mon)

- ADP Employment (Wed)

- ISM Services (Wed)

- US Jobless Claims (Thu)

- PCE Inflation (Fri)

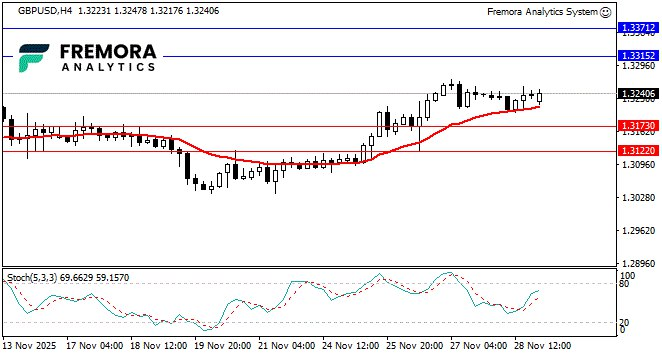

Technical Outlook (H4)

- Stochastic rising → strengthening momentum

- Price above 20MA → bullish structure

- Near-term consolidation likely before continuation

Updated Levels (4H)

Current Price: 1.3241

| Resistance | Support |

|---|---|

| 1.3315 | 1.3173 |

| 1.3371 | 1.3122 |

Fremora Takeaway

GBP/USD remains bullish but extended.

Expect consolidation between 1.3173–1.3315 before the next move.

Fed-BoE divergence (Fed dovish, BoE cautious) still favors GBP/USD upside.

Join Our Community

Real-time charts • Tools • Analysis

Telegram → http://t.me/fremorafree

Disclaimer

Educational content only — not investment advice.