EUR/USD — Dollar Weakness Holds Pair Near Monthly High

Key Highlights

• EUR/USD consolidates near 1.1740 after testing 1.1762

• USD pressured by Fed cut and weaker US labor data

• Markets still price two Fed cuts in 2026 despite hawkish dots

• ECB expectations remain unchanged ahead of December meeting

Market Overview

EUR/USD remains elevated near monthly highs as broad US Dollar weakness continues to dominate price action. The pair has stabilized after last week’s surge, driven by the Fed’s rate cut and rising speculation that US labor conditions are deteriorating faster than policymakers project. With Europe offering few near-term catalysts, flows remain USD-driven rather than euro-led.

Technical Outlook (H4)

• Price holding above 20-period MA

• Stochastic cooled to mid-range from overbought

• Structure remains bullish with consolidation underway

Key Levels

Resistance: 1.1795; 1.1852

Support: 1.1685; 1.1623

Fremora Takeaway

EUR/USD is digesting gains rather than reversing. As long as price holds above 1.1685, the broader bullish structure remains intact. The next directional move will depend on US inflation and labor data reinforcing—or challenging—expectations of deeper Fed easing in 2026.

GOLD (XAU/USD) — Bullish Trend Intact After Record Test

Key Highlights

• Gold consolidates above $4,300 after testing record zone

• Fed cut and rising jobless claims weaken USD further

• Banks project $4,900–$5,000 targets into 2026

• Safe-haven demand remains firm despite risk-on sentiment

Market Overview

Gold remains firmly bid after a strong multi-week rally, pausing just below record highs. The metal continues to benefit from falling US yields, a weaker Dollar, and growing conviction that the Fed will need to ease more aggressively than its official projections suggest. Recent US jobless claims reinforced this narrative, keeping downside pressure limited.

Technical Outlook (H4)

• Price holding above 20-period MA

• Stochastic easing but still elevated

• Bullish structure remains intact

Key Levels

Resistance: 4353.54; 4412.29

Support: 4262.81; 4204.23

Fremora Takeaway

Gold remains structurally bullish despite short-term consolidation. As long as price holds above $4,262, pullbacks are corrective rather than trend-changing. Weak US data keeps upside risks dominant heading into year-end.

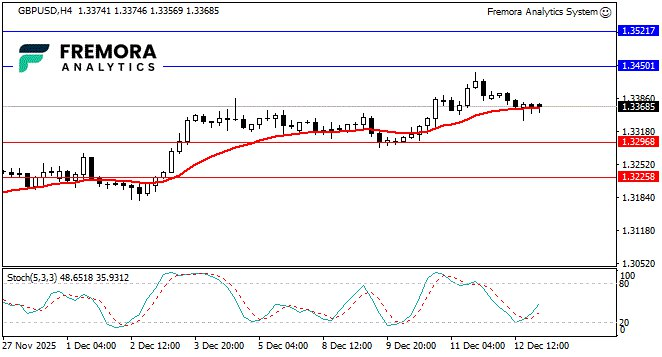

GBP/USD — Sterling Holds Gains Ahead of BoE Decision

Key Highlights

• GBP/USD consolidates near 1.3370 after testing 1.3400

• Rally driven mainly by USD weakness, not UK data

• Markets price ~90% chance of BoE rate cut on Dec 18

• UK labor and inflation data next week key for direction

Market Overview

GBP/USD is holding firm after posting its third consecutive weekly gain, pausing below the 1.3400 handle as markets await key UK events. The pair’s strength has been largely USD-driven following the Fed’s rate cut, rather than stemming from domestic UK catalysts. With the Bank of England approaching a potentially close decision, traders are cautious about extending positions ahead of incoming labor and inflation data.

Technical Outlook (H4)

• Price consolidating around the 20-period MA

• Stochastic attempting to turn higher from lower levels

• Bullish structure remains intact after recent advance

Key Levels

Resistance: 1.3450; 1.3522

Support: 1.3297; 1.3226

Fremora Takeaway

GBP/USD is pausing, not reversing. As long as price holds above 1.3297, the broader bullish structure remains valid. Direction into year-end will depend on whether UK data allows the BoE to sound less dovish than the Fed, reinforcing policy divergence.

Join Our Community

Real-time charts • Tools • Analysis

Telegram → http://t.me/fremorafree

Disclaimer

Educational content only — not investment advice.