EUR/USD — Soft CPI Fails to Lift Euro

Key Highlights

• EUR/USD slips despite softer US CPI

• ECB projections reinforce growth concerns

• US inflation undershoots but data reliability questioned

• Dollar stabilizes near 98.40

Market Overview

EUR/USD trades near 1.1720 after failing to benefit from softer US inflation data. While the CPI miss initially pressured the Dollar, ECB economic projections and lack of dovish signaling limited Euro upside. Markets remain cautious, questioning the CPI data quality following the October report cancellation.

Technical Outlook (H4)

• Stochastic drifting toward oversold

• Price below 20-period MA

• Weak momentum but selling pressure easing

Key Levels

Resistance: 1.1775; 1.1829

Support: 1.1670; 1.1614

Fremora Takeaway

EUR/USD remains heavy but downside momentum is slowing. A hold above 1.1670 keeps scope for a corrective bounce if Dollar weakness resumes.

GOLD (XAU/USD) — Gold Stalls as Risk Appetite Returns

Key Highlights

• Gold fails to hold CPI-driven rally

• Softer inflation boosts equities instead

• CPI reliability concerns dampen conviction

• Risk-on tone caps safe-haven demand

Market Overview

Gold trades flat near $4,330 after retreating from session highs. Despite a clear inflation miss, markets interpreted the data as supportive for growth rather than recession risk, driving flows into equities and limiting gold’s upside.

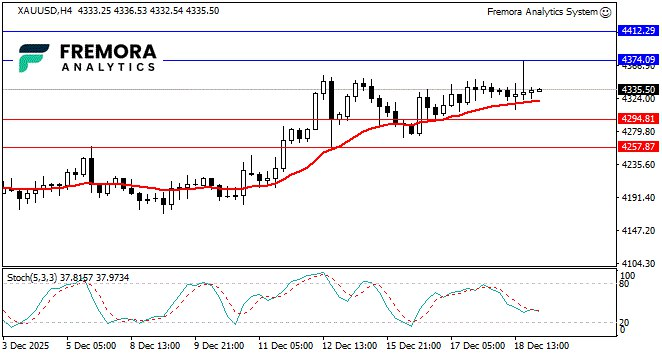

Technical Outlook (H4)

• Stochastic neutral

• Price holding above 20-period MA

• Consolidation phase developing

Key Levels

Resistance: 4374.09; 4412.29

Support: 4294.81; 4257.87

Fremora Takeaway

Gold remains structurally bullish but lacks immediate catalyst. Holding above $4,295 keeps upside intact, though consolidation may persist into year-end.

GBP/USD — Sterling Steady After BoE Cut

Key Highlights

• BoE cuts rates by 25 bps as expected

• Narrow 5–4 vote highlights internal division

• Softer US CPI limits Dollar upside

• Sterling holds near post-decision range

Market Overview

GBP/USD trades around 1.3380 after a volatile session driven by the Bank of England’s rate decision and US inflation data. The BoE delivered the widely expected 25 basis point cut to 3.75%, with a narrow 5–4 vote reflecting persistent disagreement within the committee. While UK inflation remains above target, the recent slowdown gave policymakers room to ease. Softer US CPI initially pressured the Dollar, but uncertainty around the data’s reliability capped Sterling gains.

Technical Outlook (H4)

• Stochastic stabilizing in neutral zone

• Price consolidating near 20-period MA

• Momentum balanced, range-bound conditions

Key Levels

Resistance: 1.3437; 1.3489

Support: 1.3312; 1.3259

Fremora Takeaway

GBP/USD is consolidating after absorbing both BoE easing and softer US inflation. A break above 1.3437 would reopen upside, while failure to hold 1.3312 risks deeper consolidation.

Join Our Community

Real-time charts • Tools • Analysis

Telegram → http://t.me/fremorafree

Disclaimer

Educational content only — not investment advice.