SPX/USD — AI Selloff Extends Market Rotation

Key Highlights

• S&P extends losses on AI valuation concerns

• Oracle, Nvidia, Broadcom lead tech decline

• Rotation into value and defensives continues

• CPI risk dominates near-term direction

Market Overview

US equities remain under pressure as investors reassess AI investment returns. Selling remains concentrated in mega-cap growth, while broader market rotation suggests rebalancing rather than systemic risk.

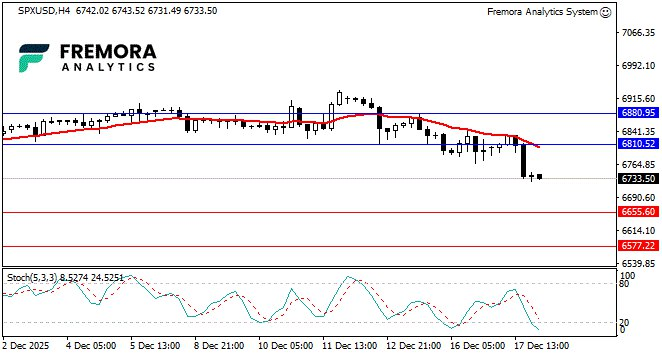

Technical Outlook (H4)

• Stochastic nearing oversold

• Price trading below 20-period MA

• Bearish momentum accelerating

Key Levels

Resistance: 6810.52; 6880.95

Support: 6655.60; 6577.22

Fremora Takeaway

As long as SPX remains below 6,810, rallies are corrective. CPI will determine whether the index stabilizes or extends toward 6,650 support.

USO/USD (WTI) — Oversupply Caps Recovery Attempts

Key Highlights

• WTI rebounds modestly from multi-year lows

• Venezuela blockade offers temporary support

• Structural oversupply remains dominant theme

• Banks forecast sub-$55 prices into 2026

Market Overview

Oil prices staged a technical rebound, but sentiment remains bearish amid severe oversupply projections. Geopolitical disruptions provide only temporary relief as storage builds and production growth overwhelm demand.

Technical Outlook (H4)

• Stochastic pushing higher

• Price hovering near 20-period MA

• Bounce lacks conviction

Key Levels

Resistance: 57.78; 58.80

Support: 55.58; 54.46

Fremora Takeaway

WTI’s rebound looks corrective within a broader downtrend. Failure above 57.80 keeps downside risk toward $54 intact unless supply fundamentals materially change.

Join Our Community

Real-time charts • Tools • Analysis

Telegram → http://t.me/fremorafree

Disclaimer

Educational content only — not investment advice.