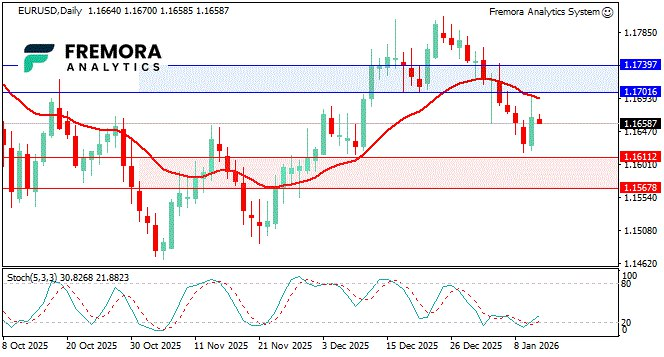

EUR/USD – Relief Bounce Still Capped Below 1.1700

Key Highlights

- EUR/USD rebounds as USD gives back four-day run

- Powell investigation headline hits USD sentiment

- Focus shifts to US CPI as next big trigger

- Europe calendar light; USD politics + inflation drive price

Market Overview

EUR/USD found relief after last week’s steep slide, with the dollar losing momentum as markets react to Fed-independence headlines. The Justice Department investigation into Chair Powell has injected policy uncertainty into USD pricing, and traders are now treating Tuesday’s US CPI as the deciding catalyst for whether the dollar resumes its rebound or fades further.

Technical Outlook (H4)

- Stochastic cooling after Monday’s recovery push

- Price consolidating around the 20-period EMA

- Still needs a clean break above 1.1702 to confirm continuation

Key Levels

Resistance: 1.1702; 1.1740

Support: 1.1611; 1.1568

Fremora Takeaway

This is a pause-and-react setup: CPI decides the next leg. A hot core print can drag EUR/USD back toward 1.1611, while a soft CPI keeps the bounce alive and puts 1.1702–1.1740 back in play.

GOLD – Record Zone, But Momentum Cooling

Key Highlights

- Gold stays elevated after record-driven surge

- Fed-independence risk keeps safe-haven bid alive

- CPI is the key risk event for the next swing

- Bull trend intact, but short-term digestion likely

Market Overview

Gold remains supported near record territory, fueled by the same political risk premium hitting the dollar. Markets are pricing the possibility that policy credibility gets challenged, which keeps demand for inflation hedges and hard assets strong. The next directional push likely depends on CPI and how markets interpret inflation in a “Fed credibility” context.

Technical Outlook (H4)

- Stochastic easing from overbought after a strong run

- Price holding above the 20-period EMA

- Consolidation is healthy unless 4549 breaks decisively

Key Levels

Resistance: 4631.83; 4687.67

Support: 4549.13; 4493.70

Fremora Takeaway

Gold is still in control structurally, but it may need consolidation before the next extension. CPI can create a two-way spike: soft inflation supports another push toward 4632+, while a hot print risks a pullback toward 4549–4494.

GBP/USD – Sterling Tracks USD Politics and CPI

Key Highlights

- Cable lifts with USD pullback after four-day run

- Fed credibility headlines add volatility premium

- CPI is the cleanest catalyst for direction

- UK data secondary in this tape

Market Overview

GBP/USD followed the broader USD retreat as the market repriced political risk around the Fed. Sterling’s move is still mostly USD-driven rather than UK-led, with traders treating CPI as the next major signal for whether the dollar stabilizes or loses more ground.

Technical Outlook (H4)

- Stochastic softening after Monday’s rebound

- Price consolidating slightly above the 20-period EMA

- Resistance sits tight near 1.3508–1.3549

Key Levels

Resistance: 1.3508; 1.3549

Support: 1.3435; 1.3393

Fremora Takeaway

Cable is in a “USD event-risk range.” If CPI is firm, GBP/USD risks slipping back toward 1.3435. If CPI disappoints, 1.3508 is the first breakout gate, with 1.3549 as the next target.

Join Our Community

Real-time charts • Tools • Analysis

Telegram → http://t.me/fremorafree

Disclaimer

Educational content only — not investment advice.