EUR/USD — Consolidates Ahead of Fed Outcome

Key Highlights

- EUR/USD extends pullback into a fourth session

- USD firms on stronger ADP and JOLTS data

- Fed expected to cut 25 bps, dot plot in focus

- Pair approaches key support near 1.1600

Market Overview

EUR/USD slipped toward 1.1625 on Tuesday as the Dollar regained momentum ahead of the final FOMC meeting of the year. Stronger-than-expected ADP private payrolls and JOLTS job openings reinforced confidence in the US labor market, lifting Treasury yields and pushing the US Dollar Index toward its 200-day SMA.

Markets still assign an 87% probability to a quarter-point cut today, but the real driver will be the Fed’s 2026 rate path.

A cautious dot plot or restrictive tone from Powell would extend USD strength.

The euro side remains quiet, with attention only on remarks from ECB officials Machado, Lagarde, and Donnery.

Technical Outlook (H4)

- Stochastic moves lower toward oversold

- Price trades below the 20-period MA, signaling bearish bias

- Pullback nears structural support at 1.1602

Key Levels

| Resistance | Support |

|---|---|

| 1.1656 | 1.1602 |

| 1.1681 | 1.1577 |

Fremora Takeaway

EUR/USD is coiled around a decisive level.

A dovish Fed → recovery toward 1.1656.

A hawkish Fed → break toward 1.1577.

Volatility expected to spike during Powell’s Q&A session.

GOLD — Holds Ground as Traders Position for Fed

Key Highlights

- Gold steady near $4,210 despite firmer USD

- Market waits for Fed guidance and dot plot

- Real yields hold near recent highs

- Ascending channel structure remains intact

Market Overview

Gold traded in a narrow range around $4,208, showing notable resilience even as the USD advanced. Strong labor data typically pressures gold, yet traders remain focused on today’s Fed projections — the key determinant for real yields and dollar direction.

The metal continues to respect its medium-term ascending channel, signaling persistent accumulation. While a 25-bps cut is fully priced in, expectations for 2026 easing will determine whether gold retests last week’s highs near $4,274.

Technical Outlook (H4)

- Stochastic turns lower near overbought area

- Price stabilizes around 20-period MA

- Conditions favor short-term consolidation

Key Levels

| Resistance | Support |

|---|---|

| 4274.57 | 4145.11 |

| 4341.25 | 4082.07 |

Fremora Takeaway

Gold is balanced — not bearish, not impulsive — awaiting Fed clarity.

A dovish dot plot → upside continuation toward 4274.

A hawkish message → drift toward 4145 before buyers return.

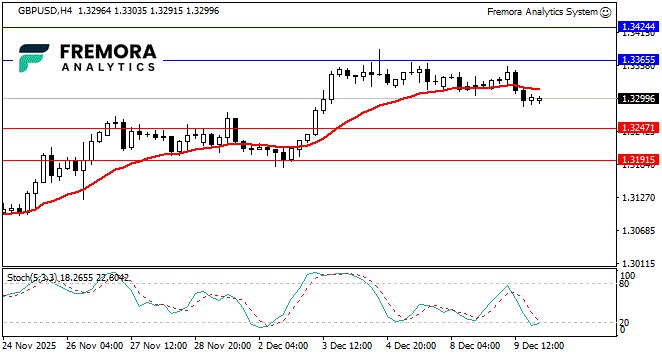

GBP/USD — Pulls Back After Strong Rally

Key Highlights

- GBP/USD slips below 1.3300

- USD strength overrides BoE’s hawkish tone

- Market reprices ahead of Powell

- UK data takes a back seat to Fed event

Market Overview

Sterling eased to 1.3299 after failing to hold above the 1.3300 handle. Tuesday’s stronger US employment readings bolstered the Dollar, overwhelming the supportive UK backdrop.

The pound’s correction appears technical — a cooling phase after last week’s surge toward the 200-day SMA.

Domestic catalysts remain limited, with today’s Fed guidance expected to dominate GBP flows.

Technical Outlook (H4)

- Stochastic attempts a bullish cross from oversold

- Price trades slightly below the 20-period MA

- Pair may attempt a recovery if 1.3247 holds

Key Levels

| Resistance | Support |

|---|---|

| 1.3366 | 1.3247 |

| 1.3424 | 1.3192 |

Fremora Takeaway

GBP/USD sits at a short-term decision point.

Fed dovish → reclaim 1.3300 and target 1.3366.

Fed hawkish → push toward 1.3247.

Join Our Community

Real-time charts • Tools • Analysis

Telegram → http://t.me/fremorafree

Disclaimer

Educational content only — not investment advice.