EUR/USD – Euro Pauses Below Key Resistance

Key Highlights

- Holiday liquidity keeps EUR/USD range-bound

- Fed cut expectations still weigh on USD

- ECB policy divergence caps upside

- Focus on FOMC Minutes midweek

Market Overview

EUR/USD trades quietly near 1.1713 as markets enter holiday-thinned conditions. Reduced participation is limiting follow-through despite ongoing USD softness. With little Eurozone data scheduled, positioning remains cautious ahead of the FOMC Minutes.

Technical Outlook (H4)

- Stochastic stabilizing near oversold

- Price below 20-period MA

- Downside momentum slowing

Key Levels

- Resistance: 1.1775; 1.1829

- Support: 1.1670; 1.1614

Fremora Takeaway

EUR/USD is compressing into a narrow range. A reclaim of 1.1775 is needed to revive upside, while failure to hold 1.1670 risks a deeper holiday-driven dip.

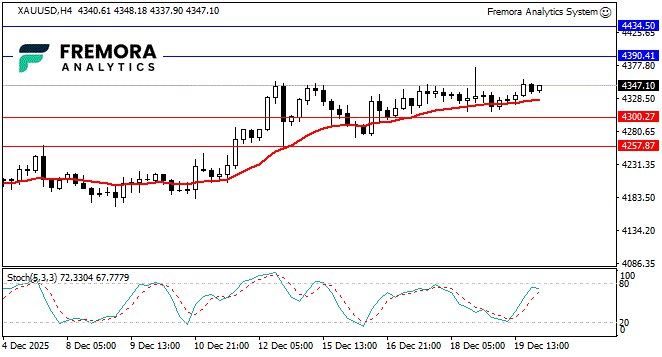

GOLD – Bullish Structure Holds Above $4,300

Key Highlights

- Gold holds firm above $4,300

- Fed easing expectations support prices

- Real yields remain compressed

- Thin liquidity may exaggerate moves

Market Overview

Gold consolidates near 4,347 as buyers defend the post-CPI breakout zone. The broader macro backdrop remains supportive, though holiday trading limits momentum expansion.

Technical Outlook (H4)

- Stochastic rising toward overbought

- Price above 20-period MA

- Bullish bias intact

Key Levels

- Resistance: 4390.41; 4434.50

- Support: 4300.27; 4257.87

Fremora Takeaway

Gold remains structurally bullish. As long as $4,300 holds, dips are corrective, with upside continuation favored on any renewed USD weakness.

GBP/USD – Sterling Trapped in Holiday Range

Key Highlights

- GBP/USD stabilizes after BoE cut

- Policy divergence still favors GBP

- Liquidity thinning into Christmas

- Limited UK catalysts near-term

Market Overview

GBP/USD trades sideways near 1.3380 as markets digest the BoE’s recent rate cut. With major events behind and liquidity fading, Cable remains driven by positioning rather than fundamentals.

Technical Outlook (H4)

- Stochastic neutral

- Price near 20-period MA

- Range conditions persist

Key Levels

- Resistance: 1.3437; 1.3489

- Support: 1.3312; 1.3259

Fremora Takeaway

GBP/USD is in consolidation mode. A break outside the 1.3312–1.3437 range will be needed to define the next directional move.

Join Our Community

Real-time charts • Tools • Analysis

Telegram → http://t.me/fremorafree

Disclaimer

Educational content only — not investment advice.