📈 SPX/USD — S&P 500 Finishes Strongest Week Since June

Key Highlights

- SPX/USD trades at 6860, +3.73% on the week

- Fed cut odds at 85% trigger broad risk rally

- November ends slightly positive despite mid-month weakness

- Mega-cap tech rebounds: Apple ATH, Broadcom +18%

Market Overview

Thanksgiving week delivered a major sentiment reversal, helping the S&P 500:

✔ Break a 3-week slide

✔ Log its best weekly performance since June

✔ Finish November positive

The catalysts:

- New York Fed’s Williams supports cuts

- Market embraces early-December easing

- Labor trends soft enough to justify cuts

- Strong online holiday shopping season

- Resilient mega-cap tech earnings

Surprisingly:

- The Nasdaq still finished November –1.5%, signaling lingering concerns about tech valuations.

This week brings high-impact macro catalysts:

- ISM Manufacturing (Mon)

- ADP Employment (Wed)

- ISM Services (Wed)

- PCE Inflation (Fri) — the most important

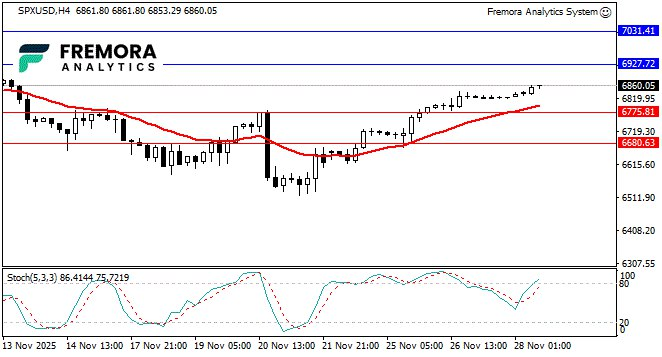

Technical Outlook (H4)

- Stochastic rising → renewed bullish momentum

- Price above 20MA → trend intact

- Next stop: 6927

Updated Levels (4H)

Current Price: 6860.05

| Resistance | Support |

|---|---|

| 6927.72 | 6775.81 |

| 7031.41 | 6680.63 |

Fremora Takeaway

The S&P looks strong heading into December.

Break 6927 → target 7031.

Pullbacks into 6775 likely get bought unless PCE shocks higher.

🛢 WTI CRUDE (USO/USD) — Oil Attempts Recovery But Fundamentals Still Weak

Key Highlights

- WTI trades at 59.35, rebounding from November lows

- Peace signals in Russia-Ukraine cut risk premium

- US sanctions create supply uncertainty

- OPEC+ expected to keep output steady

Market Overview

WTI is stabilizing after weeks of selling, boosted by:

✔ Slightly improved geopolitical tone

✔ Traders positioning ahead of key OPEC+ dates

✔ A technical rebound from oversold levels

But medium-term fundamentals still point bearish:

- Russian supply uncertainty (sanctions)

- Global supply to rise by 3.1m bpd in 2025

- Commercial inventories rising

- US production at record levels

- Chinese demand rolling over due to EV + LNG shift

Market expectations:

- OPEC+ to maintain current output strategy

- No supply cuts anticipated

- Risk premium compressed → lowers prices

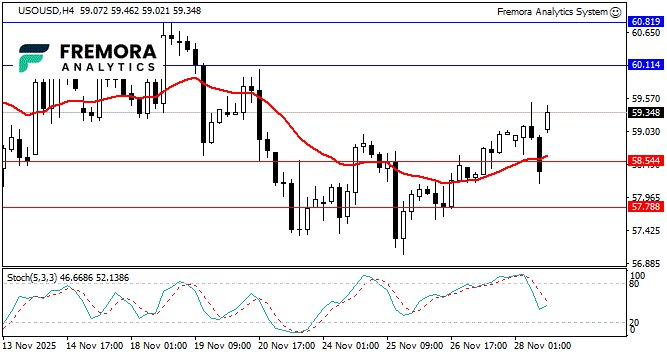

Technical Outlook (H4)

- Stochastic cooling → momentum losing strength

- Price above 20MA → short-term recovery

- Rally likely corrective, not trend reversal

Updated Levels (4H)

Current Price: 59.35

| Resistance | Support |

|---|---|

| 60.11 | 58.54 |

| 60.82 | 57.79 |

Fremora Takeaway

WTI’s bounce is technical, not structural.

Break above 60.11 could extend toward 60.82, but fundamental risks remain to the downside.

Medium-term: still bearish unless OPEC surprises with supply cuts.

Join Our Community

Charts • Signals • Discussions

Telegram → http://t.me/fremorafree

Disclaimer

This report is for educational purposes only. Not financial advice.