STOCKS (S&P 500) — Recovery Extends, but Momentum Cools Into Resistance

Key Highlights

- S&P 500 extends a two-day rebound on improved sentiment

- Trump reiterates Greenland “framework,” lowering tariff risk

- US data remains strong, reinforcing growth backdrop

- Market fades off intraday highs, signaling caution

Market Overview

US equities climb further as geopolitical relief supports risk-on positioning, pushing the S&P 500 back toward key resistance near 7,000. However, the fade from intraday highs suggests traders remain cautious about durability—relief rallies can lose traction quickly if uncertainty returns. Underlying macro data remains supportive, but markets appear more sensitive to headline stability than to incremental economic beats.

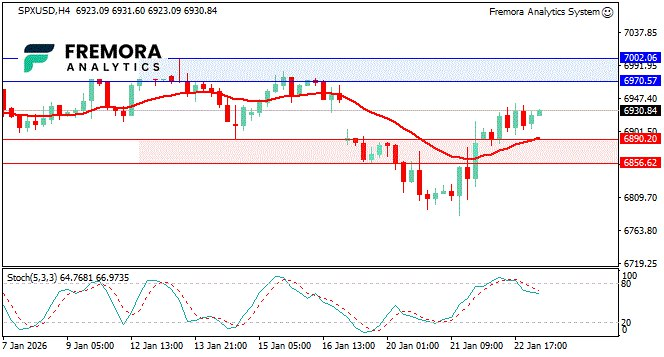

Technical Outlook (H4)

- Stochastic easing from overbought levels

- Price consolidating above the 20-period EMA

- Structure remains bullish, but near-term digestion is likely

Key Levels

- Resistance: 6970.57; 7002.06

- Support: 6890.20; 6856.62

Fremora Takeaway

The index is recovering, but the market is still trading “headline-first.” Bulls retain control above the 20 EMA, yet the 7,000 zone is a pressure point where positioning and profit-taking can dominate without breaking the broader recovery trend.

OIL (WTI) — Risk Premium Unwinds as Supply Upside Scenarios Return

Key Highlights

- WTI drops as geopolitical risk premium fades

- Trump softens stance on Greenland and Iran risk

- Russia-Ukraine progress revives supply expansion expectations

- Venezuela export and reform headlines add supply pressure

Market Overview

WTI retreats sharply before stabilizing near 59.83 as traders unwind risk premium tied to geopolitical escalation. With de-escalation signals emerging and potential supply additions back in focus—via Russia sanctions relief scenarios and increased Venezuelan flows—crude is trading more like a supply-optional market than a geopolitical hedge. Demand narratives remain secondary, with price responding primarily to policy and supply-risk recalibration.

Technical Outlook (H4)

- Stochastic attempting to turn higher from oversold

- Price consolidating slightly below the 20-period EMA

- Setup suggests bounce potential, though bearish structure persists

Key Levels

- Resistance: 60.66; 61.74

- Support: 58.51; 57.62

Fremora Takeaway

Oil is being repriced around “less risk, more supply,” which caps upside even if the market bounces technically. A reclaim of the 20 EMA would help stabilize price action, but sustained recovery requires either renewed risk premium or clearer demand strength.

Join Our Community

Real-time charts • Tools • Analysis

Telegram → http://t.me/fremorafree

Disclaimer

Educational content only — not investment advice.